The Buzz on Summitpath Llp

The Buzz on Summitpath Llp

Blog Article

The Facts About Summitpath Llp Uncovered

Table of ContentsGetting My Summitpath Llp To WorkThe Summitpath Llp DiariesWhat Does Summitpath Llp Mean?The 9-Second Trick For Summitpath Llp

Most just recently, introduced the CAS 2.0 Method Growth Mentoring Program. https://www.storeboard.com/summitpathllp. The multi-step mentoring program consists of: Pre-coaching placement Interactive group sessions Roundtable conversations Embellished mentoring Action-oriented mini intends Companies aiming to increase right into consultatory services can additionally transform to Thomson Reuters Technique Onward. This market-proven technique provides material, tools, and assistance for firms interested in advising servicesWhile the modifications have unlocked a number of development opportunities, they have actually additionally resulted in challenges and problems that today's firms require to have on their radars., firms need to have the capability to rapidly and effectively carry out tax research study and improve tax obligation reporting performances.

Driving better automation and making certain that systems are snugly incorporated to simplify workflows will assist reduce bandwidth concerns. Companies that remain to operate siloed, legacy systems danger shedding time, money, and the trust fund of their clients while increasing the chance of making mistakes with hand-operated entrances. Leveraging a cloud-based software program remedy that functions flawlessly with each other as one system, sharing information and procedures throughout the firm's workflow, could show to be game-changing. Additionally, the new disclosures may result in an increase in non-GAAP procedures, traditionally an issue that is highly scrutinized by the SEC." Accountants have a great deal on their plate from regulatory changes, to reimagined business versions, to a rise in customer expectations. Maintaining pace with it all can be challenging, yet it does not have to be.

An Unbiased View of Summitpath Llp

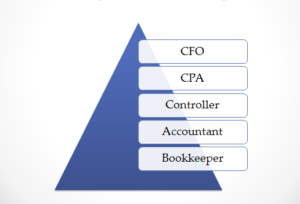

Listed below, we explain four CPA specialties: tax, administration accountancy, economic coverage, and forensic accounting. CPAs focusing on taxes help their clients prepare and file income tax return, reduce their tax obligation burden, and stay clear of making blunders that might cause expensive fines. All CPAs require some understanding of tax law, yet concentrating on taxes indicates this will be the focus of your job.

Forensic accounting professionals typically start as basic accountants and move right into forensic accountancy roles gradually. They need solid analytical, investigative, organization, and technological bookkeeping abilities. Certified public accountants who specialize in forensic audit can often go up into monitoring accountancy. CPAs require at the very least a bachelor's degree in accounting or a comparable field, and they must complete 150 credit report hours, including audit and company courses.

No states need a graduate degree in bookkeeping., auditing, and taxation.

Bookkeeping also makes practical feeling to me; it's not simply theoretical. The CPA is a crucial credential to me, and I still obtain continuing education credit scores every year to keep up with our state requirements.

Summitpath Llp Fundamentals Explained

As a freelance specialist, I still make use of all the fundamental structure blocks of bookkeeping that I found out in college, seeking my certified public accountant, and operating in public accounting. Among the important things I truly like about audit is that there are various tasks available. I determined that I wanted to begin my occupation in public bookkeeping in order to find out a lot in a short time period and be subjected to different sorts of clients and different areas of audit.

"There are some offices that don't want to think about somebody for an accountancy function who is not read review a CPA." Jeanie Gorlovsky-Schepp, CPA A CPA is a very valuable credential, and I desired to place myself well in the industry for numerous work - Calgary Bookkeeping firm. I made a decision in college as a bookkeeping significant that I intended to try to obtain my CPA as soon as I could

I have actually satisfied a lot of fantastic accounting professionals that don't have a CPA, yet in my experience, having the credential really helps to market your knowledge and makes a distinction in your payment and occupation options. There are some offices that don't intend to take into consideration somebody for a bookkeeping duty that is not a CPA.

Not known Facts About Summitpath Llp

I truly appreciated working on different kinds of tasks with different customers. In 2021, I determined to take the following step in my accounting job journey, and I am now an independent bookkeeping expert and company consultant.

It continues to be a growth location for me. One crucial quality in being a successful certified public accountant is genuinely appreciating your customers and their companies. I enjoy dealing with not-for-profit customers for that really reason I really feel like I'm actually adding to their objective by aiding them have good monetary information on which to make wise business choices.

Report this page